Deciding What to Give

Cash: A Popular Gift

We commonly receive gifts in the form of cash, checks, and electronic transfers. Cash gifts can be convenient for many people and are easily recorded through receipts and bank records. Remember that it is important to save all receipts for tax purposes.

Non-Cash Gifts: Enjoy More Savings

Many Youth Villages supporters choose to make their charitable gifts in forms other than cash. Popular examples include:

- Securities – Giving stocks, bonds or mutual funds that have increased in value may help you reduce taxes and conserve cash.

- Retirement plan distributions – These assets can be a practical resource for charitable gifts now or in your long-range estate plans.

- Life insurance policies – Using life insurance for gifts to Youth Villages can be a convenient way to make a tax-effective gift.

- Real estate – An often overlooked resource, real estate can be an excellent way to make a meaningful gift that could enhance your income or generate tax savings.

- Other items of value (jewelry, artwork, collections, antiques, automobiles, etc.)

After considering the properties you own, you may find a gift of property other than cash to be an attractive alternative. Giving in this way may enable you to make gifts while conserving cash for other uses and enjoying what may be greater tax savings than those provided by gifts of cash.

When Property is Worth More

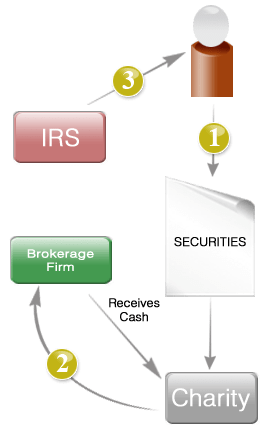

If you have property, such as stocks and mutual funds, that is worth more than you paid for it and it has been owned for more than a year, you can generally enjoy greater tax savings from giving that property than from giving an equivalent amount of cash. That’s because a gift of such property lets you bypass capital gains tax that could be due if you sold the asset. You are also entitled to a charitable income tax deduction based on the property’s current value, including any “paper profit.”

Example

Jordan is in the 35% tax bracket and a 15% capital gains tax bracket and would like to make a $10,000 gift to Youth Villages. Jordan gives appreciated securities with a cost basis of $2,000 instead of cash. Youth Villages sells the securities, pays no capital gains tax, and receives $10,000, less expenses, from the sale. Jordan receives a charitable income tax deduction in the amount of $10,000 and pays no capital gains taxes on the sale of the securities, saving $1,200. The cost of the gift net of all tax savings has been reduced to $5,300 ($10,000 – $3,500 – $1,200), a savings of $1,200 over cash. View Full Text Version NOTE: This calculation is provided for educational purposes only. The type of assets transferred, the actual date of the gift, and other factors may have a material effect on the amount or use of your deduction. You are advised to seek the advice of your tax advisors before implementing a gift of this type. Planning Tip: If you have owned a security for more than a year, it has increased in value, and you think it may be worth more in the future, it may be best to give the stock and at the same time repurchase the same number of shares with the cash you otherwise would have used to make the gift. This will increase the basis in your stock to 100% of its current value and save you capital gains taxes in the future should you sell the stock. This may also make it possible to benefit from a loss deduction should the stock decline in value before it is sold.

NOTE: This calculation is provided for educational purposes only. The type of assets transferred, the actual date of the gift, and other factors may have a material effect on the amount or use of your deduction. You are advised to seek the advice of your tax advisors before implementing a gift of this type.

Giving Property that has Declined in Value

If you have stock or other investment property that is worth less than it cost, you will normally save more in taxes by selling that property and giving the proceeds. You may then be able to claim a capital loss on your tax return. You can also deduct the cash proceeds you give as a charitable gift. The result can be to enjoy tax deductions that actually total more than the current value of the asset while making a meaningful gift.