Making Gifts While Providing for Inheritances

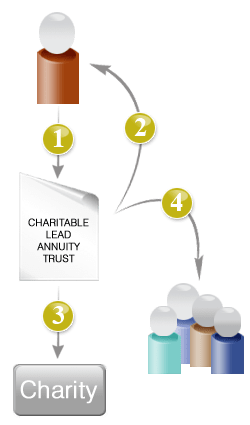

Known as a charitable lead trust, this increasingly popular plan can be used to achieve what might otherwise seem to be conflicting goals, while you also enjoy significant tax savings and other financial benefits. See Example

Consider the benefits of a charitable lead trust

- You arrange for a regular source of charitable gifts that will begin immediately and continue for as long as you decide.

- The amount of the charitable gifts can be fixed or vary over time.

- You or your advisors can continue to manage the funds in the trust, if desired.

- Such a gift can serve to reduce or eliminate income, estate, and gift taxes now – and in future years as well.

- You may be able to provide younger heirs with a larger inheritance than would otherwise be possible at a time when it is more appropriate that it be received.

You may be familiar with charitable gift planning tools that feature annual income for you or others you choose. Under these plans, when income ceases, any remaining funds are transferred to the charity. Under the terms of a charitable lead trust, however, your charitable interests immediately begin to receive gifts in the form of payments from the trust and the gifts continue for the period of time you determine. At the end of that time period, assets remaining in the trust are returned to you or other loved ones you designate.

Gift and estate taxes can be due on amounts over a certain amount given to others during your lifetime or through your estate. Because of the front-end gifts to charity over time from a charitable lead trust, however, you are allowed to reduce the amounts that would otherwise be taxable by the value of those gifts to charity.

Depending on the amount of the payments, how long they last, and other factors, it can be possible to greatly reduce, or even entirely eliminate, gift and estate tax on unlimited amounts ultimately passing to heirs. In addition, at the termination of the trust your heirs can benefit from any growth in trust assets, free of additional gift and estate taxes, during the time the trust is in existence.

As you can see, the charitable lead trust can be an especially attractive way to meet multiple personal and charitable planning goals.

Example

- Mr. and Mrs. Walker will transfer assets valued at $1,000,000 to the trust.

- The contribution to the trust will result in a gift tax deduction of $871,443.

- The trust will distribute income to Youth Villages for 20 years based on an annuity rate of 6%. The income will be $60,000 per year for a total of $1,200,000.

- When the trust terminates, the value of the trust, based on the $1,000,000 transferred, plus any growth or less any loss in trust value, will be transferred to the heirs. Based on an assumed net earnings rate of 7%, the heirs will receive an inheritance of approximately $1,409,955.

The assumed date of transfer for this example is January 3, 2019. This example has used the January 2019 IRC Section 7520 discount rate of 3.4% to optimize the charitable deduction.

NOTE: This calculation is provided for educational purposes only. The type of assets transferred, the actual date of the gift, and other factors may have a material effect on the amount or use of your deduction. You are advised to seek the advice of your tax advisors before implementing a gift of this type.