Charitable Trust

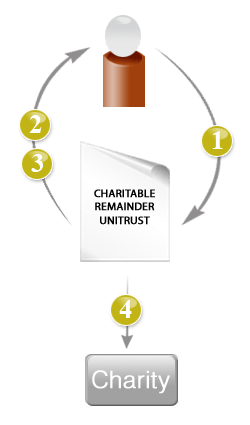

Trusts also allow a person to arrange for property to first be put to one use, then to another. For example, a charitable remainder trust offers a way to make a future gift for philanthropic purposes after first providing income for yourself and/or others you name. See Example

Here’s how a charitable remainder trust works

- A trust is drafted by an appropriate professional advisor.

- Assets are transferred to the trust to be managed by you or another person or an entity you choose as trustee.

- Payments are made from the trust to you and/or others you name for life or other period of time you determine.

- You are entitled to a federal (and perhaps state) income tax charitable deduction and you may enjoy capital gains tax savings in the year you create the trust. Amounts used to fund your trust may not be part of your probate or taxable estate.

- When the trust ends, its remaining assets become a gift to one or more charitable interests of your choosing. The gift portion is known as the charitable remainder.

There are two primary types of remainder trusts. The charitable remainder annuity trust, which provides you with a level and predictable income, and the charitable remainder unitrust, which provides you with a variable income. Each is described below.

A Gift with Predictable Income

A charitable remainder annuity trust is a way to make a gift while assuring a fixed, regular income. Income from such a trust can be a reliable income supplement in retirement years. The payments received each year must be at least 5% of the amount originally placed in the trust. You determine the exact amount when your trust is created.

Additional Content

Example

- George, age 75, decides to place assets valued at $250,000 in a charitable remainder annuity trust.

- George decides to provide for lifetime payments from the trust of 5% of $250,000, or $12,500, each year regardless of the actual earnings of the trust.

- The gift will result in an immediate charitable income tax deduction of $142,037. (The charitable income tax deduction may be carried forward for as many as five years if the deduction is more than can be used in the year of the gift.)

- At the end of the trust, the amount placed in trust, plus its net earnings, minus the payments made, will be transferred to Youth Villages to further its mission.

The assumed date of transfer for this example is January 3, 2019. This example has used the December 2018 IRC Section 7520 discount rate of 3.6% to optimize the charitable deduction.

NOTE: This calculation is provided for educational purposes only. The type of assets transferred, the actual date of the gift, and other factors may have a material effect on the amount or use of your deduction. You are advised to seek the advice of your tax advisors before implementing a gift of this type.

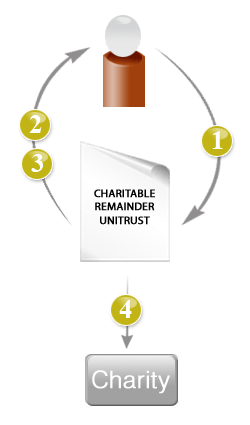

A Gift with Variable Income

Like the annuity trust, the charitable remainder unitrust provides for a gift that allows a donor to retain income for life or other period of time. But unlike the annuity trust, the income from a unitrust can fluctuate over time with the value of the assets placed in the trust.

You determine the annual payment percentage when the gift is made. Each year this percentage (at least 5%) of the value of the trust assets is paid to you or others you name. When the value of the investments goes higher, more income is received. The income will be less if the value of the assets declines. If provided for in the trust agreement, additions can be made to a unitrust and an additional tax deduction is allowed for part of any additional amounts contributed.

For those who would like to provide for an income that can grow over time, the charitable remainder unitrust can be an attractive option. Another benefit of charitable remainder trusts is the fact that no tax is payable by the trust at the time investment gains are realized, making it possible to enjoy increased income over time based on tax-free growth within the trust. This can be especially attractive to those who anticipate increases in growth in investments over time.

Example

- George, age 75, decides to place assets valued at $250,000 in a charitable remainder unitrust.

- George decides to provide for lifetime payments from the trust of 5% of $250,000, or $12,500, in the first year. Each year thereafter, the income will fluctuate based on the value of the trust.

- The gift will result in an immediate charitable income tax deduction of $150,963. (The charitable income tax deduction may be carried forward for as many as five years if the deduction is more than can be used in the year of the gift.)

- At the end of the trust the amount placed in trust, plus net earnings, minus the payments made, will be transferred to Youth Villages to further its mission.

The assumed date of transfer for this example is January 3, 2019. This example has used the December 2018 IRC Section 7520 discount rate of 3.6% to optimize the charitable deduction.

NOTE: This calculation is provided for educational purposes only. The type of assets transferred, the actual date of the gift, and other factors may have a material effect on the amount or use of your deduction. You are advised to seek the advice of your tax advisors before implementing a gift of this type.

| Description | Annuity Trust | Unitrust |

|---|---|---|

| Value of Asset Transferred to Trust | $250,000 | $250,000 |

| First Year Income | $12,500 | $12,500 |

| Annuity and Payout Rate | 5% | 5% |

| Type of Income | Level | Variable |

| Charitable Deduction | $142,037 | $150,963 |

| 10% Remainder Test | Passed | Passed |

| 5% Probability Test | Passed | N/A |

The assumed date of transfer for the examples on this page is January 3, 2019. These examples have used the December 2018 IRC Section 7520 discount rate of 3.6% to optimize the charitable deduction.

NOTE: This calculation is provided for educational purposes only. The type of assets transferred, the actual date of the gift, and other factors may have a material effect on the amount or use of your deduction. You are advised to seek the advice of your tax advisors before implementing a gift of this type.

Income for a Period of Time You Choose

It is also possible to establish a charitable remainder trust for a fixed time period of up to 20 years. Such a trust may be useful if you would like to retain income to meet your needs over a limited time frame. It is also possible to create such a trust to provide income for one or more loved ones for a particular term of years. See example.